Some companies have three weeks to respond to accusations they have set direct debits too high.

Image source, Getty Images

Some energy suppliers have been given a three-week deadline to explain accusations they have increased customers’ direct debit payments by “more than is necessary”.

Jonathan Brearley, boss of the energy regulator Ofgem, recently said there were “troubling signs” of the tactic.

He also expressed concern over customers being directed to inappropriate deals.

Official reviews have now been launched.

Energy bills

Mr Brearley had said in April that reviews were imminent, but the development emerged from an update published on Twitter by Business Secretary Kwasi Kwarteng.

Mr Kwarteng said that some energy companies had been increasing direct debits beyond what was required.

“I can confirm Ofgem has today issued compliance reviews,” Mr Kwarteng’s tweet went on.

“The regulator will not hesitate to swiftly enforce compliance, including issuing substantial fines.”

However, by reviewing the issue, Ofgem has yet to draw a firm conclusion on whether any rules have been broken.

Prime Minister Boris Johnson had earlier acknowledged “there is more that we can do” to help families struggling with rising fuel and energy bills.

Opposition parties have called for a windfall tax on energy company profits, with Labour accusing him of offering “no answers” to a “cost of living crisis”.

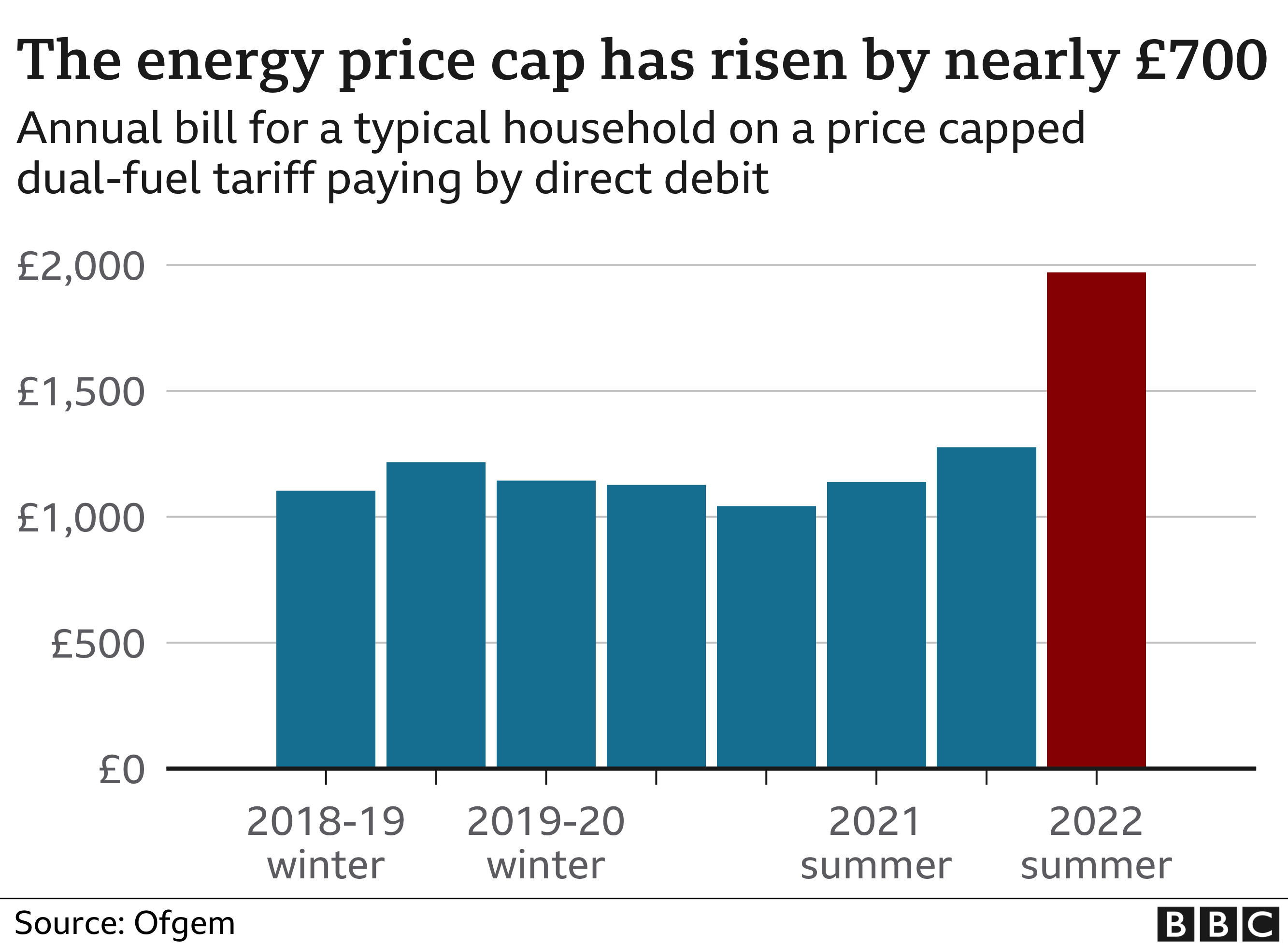

On 1 April, yearly bills increased by an average of £693 for about 18 million households on standard tariffs.

And some 4.5 million prepayment customers saw an average increase of £708 – from £1,309 to £2,017.

Mr Brearley, chief executive of Ofgem, wrote in a blog on Ofgem’s website in April that the regulator had received information from consumer groups and the public about “bad practices” by some suppliers.

“We are also seeing troubling signs that some companies are reacting to these changes by allowing levels of customer service to deteriorate,” he wrote.

He added that they were also concerned about “the way some vulnerable customers are being treated when they fall into difficulties”.

The regulator has powers to issue “substantial fines” of up to 10% of turnover to firms found failing to comply.